As we all are aware that in this covid time nothing fix. Anything can happen anytime. So we all make sure that we must be insured and our shops also get insured, so if anything misshapen our source of income must be continue and savings will be permanent shopkeeper, shop owner, shop insurance, shopkeeper meaning, shop keeper

To fix the problem Shopsecurity.in comes with a solution.

Now you can safe your shop and its content with shopkeeper policy. For this contact us and buy your shop insurance policy at less than Rs 899*

| SERVICES THROUGH SHOPSECURITY PORTAL | |

| NAME OF COMPANY | XB INFOTECH |

| TYPE | PRIVATE LIMITED |

| SERVICES | SHOPKEEPER INSURANCE |

| OFFICE | NOIDA (UP) |

| MEMBERSHIP | PAYMENT PROCESS |

| ASSOCIATES | UIIC & NIC |

- ✔️ Shop Keeper Policy

- ✔️ Personal Accidental Insurance

- ✔️ Health Insurance

- ✔️ General Insurance

- ✔️ Vehicle Insurance

How to Start Business with Shop Security

Who Don’t want to be a part of Insurance industry but for this you have to give many exams and get licence, So in short it’s a difficult to join .

But ShopSecurity has make it very easy now.

- ✔️ You can join the Shop security as an Operator or Block operator and start your own business in Insurance sector

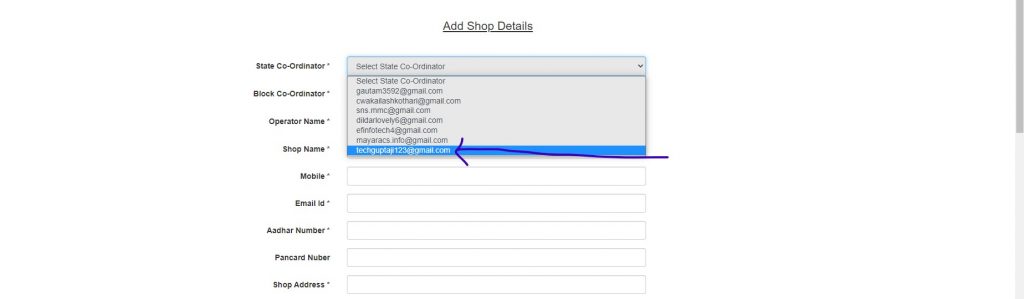

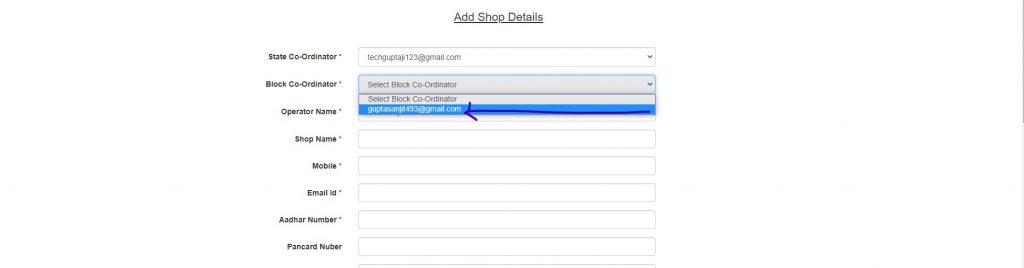

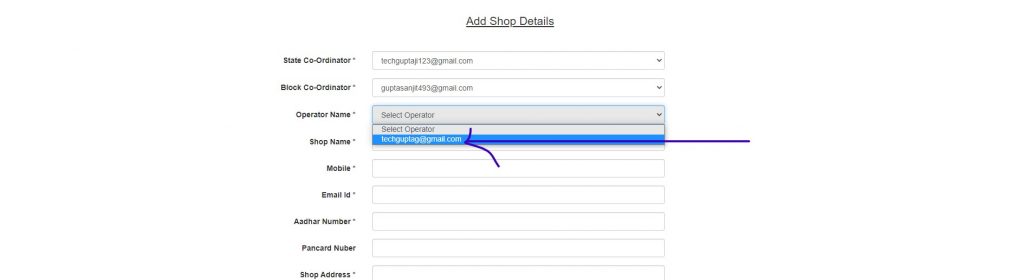

shopkeeper registration process in 2 minut ?

- ✔️ Step 1:- First click on State Ordinator

- ✔️ Step 2:- After that click on Block Ordinator

- ✔️ Step 3:- After that select operator name

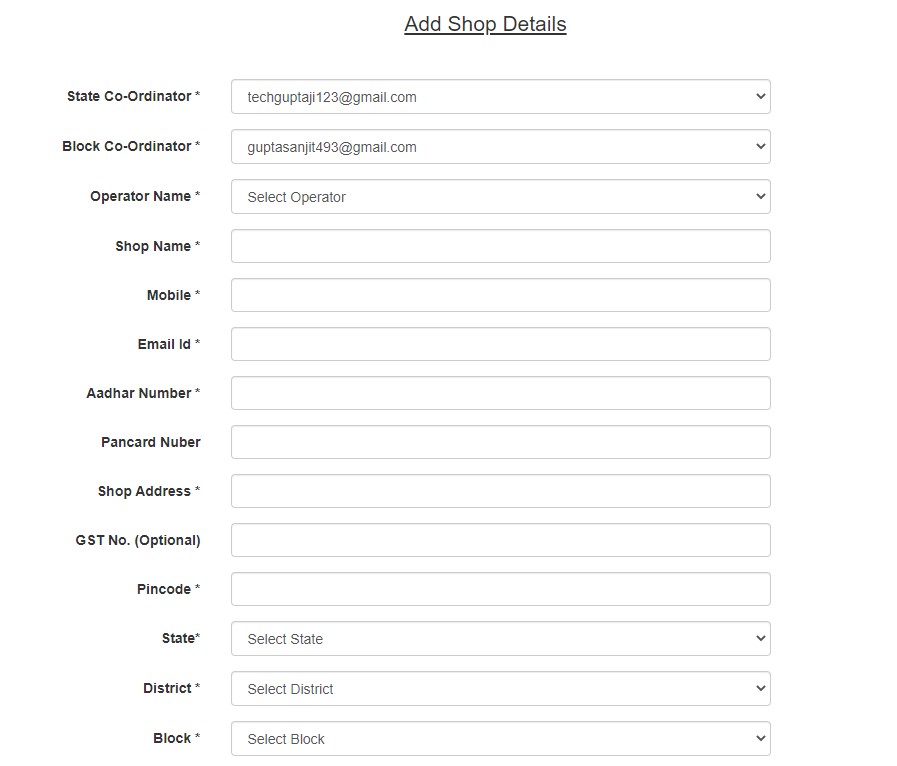

After that will tell all the information correctly, enter your state, district, block, pin code correctly on the day

What Document Required for Shop Security Operator – Documents required to become an Operator

- ✔️ Aadhar Card (Self Signed)

- ✔️ Pan Card (Self Signed)

- ✔️ Agent Passport size color photograph

- ✔️ Cancel Check

2 Way to Register Online For Shop Security Operator & Block Operator Portal

- ✔️ Website

- ✔️ Customer care

Get Shop Security ID through Website Registration

If you want to register Shop Security ID through “shopsecurity.in” the website, then you click on the link given below and a screen will open in front of you, here you have to write all your information.

You keep it safe with you, within 24 to 48 hours you will get a call from the company and your information will be authenticated and then you will get your Shopsecurity Operator User ID and Password

Second is you can call us at 18008332100,Our team will help you.

Shop Security customer care

- ✔️ 18008332100

- ✔️ [email protected]

SHOP INSURANCE

A Shop Insurance policy is designed insurance policy that provides coverage for a shop’s content and the property. This shop insurance for small to medium -sized shops cover burglary along with any mishaps due to natural calamities, accidental, fire etc

Shopkeeper Insurance provides coverage against any potential risk or mishaps the insured small and medium sized shops owners are likely to face. Thus it safeguards the policyholder’s business interest besides protecting his property

Get Rs. 2 lacks cover at minimum price ?

- ✔️ Name:-

- ✔️ Mobile No:-

- ✔️ Email Id:-

- ✔️ Message:-

Who can be insured?

Any small shopkeeper exposed to one or more of the above-named contingencies. He can choose benefits under four (minimum) or more sections. P.A Cover is offered for insured spouse and children (Age 12 – 70).

What is insured?

- ✔️ Building and contents Fire lightning Acts of God Riot Strike and malicious damage impact damage explosion of gas in domestic appliances overflow of water tanks. Burglary House breaking and Theft.

- ✔️ Money in Transit Loss due to accident or misfortune

- ✔️ Pedal Cycles Fire lightning explosion Riot Strike and Malicious Damage

- ✔️ Acts of God Burglary House breaking Theft external accident and also

- ✔️ Legal liability with a limit of Rs.10 0

- ✔️ Plate Glass (Fixed)Accidental breakage

- ✔️ Neon sign/Glow sign Fire Accidental damage Riot Strike and Malicious Act and or theft.

- ✔️ Baggage while in travel Loss due to accident or misfortune

- ✔️ Personal Accident Accidental injury causing death/disablement/loss of limb total/partial

What Will Policy Pay and How Much?

Policy will pay as per below:

- ✔️ If injury directly/solely causes within 12 months of its occurrence

- ✔️ Actual extent of loss/damage to property under respective sections chosen;

- ✔️ Sum Insured is the limit of maximum liability under respective sections;

- ✔️ Limit of liability to third party for Personal injury/Property damage is upto Rs.10 0 Pedal Cycle section respectively

Personal Accident Section

- ✔️ If injury directly/solely causes within 12 months of its occurrence

- ✔️ Death / loss of two limbs / eyes / Total permanent disablement : Full Sum Insured

- ✔️ Loss of a hand / foot / eye / use of hand / foot : 50% Sum Insured

- ✔️ Specified Percentage (%) of Sum Insured in other cases of permanent disablement [partial]

- ✔️ Weekly benefits (Rs.3000/- max.) upto 100 weeks payable for Temporary Total Disability.

What Is Not Insured

The policy will not pay loss/damage due to

- ✔️ War and war like perils

- ✔️ Wear and tear depreciation consequential loss

- ✔️ Nuclear group of perils

- ✔️ Gross and wilful negligence of Insured

- ✔️ Violation of policy conditions

- ✔️ Loss/damage/liability where Insured’s family or Insured’s employee are involved as principal/accessory

- ✔️ Intentional act/self injury/ influence of drug/intoxicant

Shop Insurance FAQs?

What insurance do you need for a shop?

A shop has three important aspects that any good insurance policy should keep at its heart. Those three things are your premises and stock (buildings and contents insurance), your customers (public liability insurance) and protection of outgoing costs should you have to stop trading (business interruption insurance)

What is Usgic shopkeeper package policy?

Shopkeepers Insurance policy is a comprehensive package policy which provides financial protection to Insured’s shop assets & other risk exposures related to business activity in a single documentation

What insurance do I need for my car?

You need Compulsory Third Party (CTP) insurance before you can register your car in NSW. CTP insurance – also known as a green slip – provides compensation for other people injured in an accident when you or the person driving your vehicle is at fault, and in certain circumstances, regardless of who was at fault

Do you really need car insurance?

Having car insurance is required by law in most states. If you are at fault in a car accident, the auto liability coverage required on your car insurance policy helps pay for covered losses, such as the other party’s medical bills and damage to their vehicle or other property that results from the accident

What are the disadvantages of car insurance?

Primary and the major disadvantage of car insurance is your policy not covers the entire vehicle. Only the specific parts of the car are under damage coverage, the policyholder needs to verify hidden clauses in the document keenly before buying the policy shopkeeper, shop owner, shop insurance, shopkeeper meaning, shop keeper shopkeeper, shop owner, shop insurance, shopkeeper meaning, shop keeper shopkeeper, shop owner, shop insurance, shopkeeper meaning, shop keeper shopkeeper, shop owner, shop insurance, shopkeeper meaning, shop keeper shopkeeper, shop owner, shop insurance, shopkeeper meaning, shop keeper

-

What is Life Insurance Policy, Car, Bike, Helth, Lic, term insurance ?

-

{Apply} up ration card list 2021 | यूपी की नयी राशन कार्ड लिस्ट 2023

-

NEP;New Education Policy In Hindi , भारत की नई शिक्षा नीति 2023

-

प्रधानमंत्री फसल बीमा योजना ( PMFBY ) ऑनलाइन फॉर्म कैसे भरें || Fasal Bima Yojana

-

Pm SVANidhi Yojana , Online Registration Application Form , पीएम स्वनिधी

Having car insurance is required by law in most states. If you are at fault in a car accident, the auto liability coverage required on your car insurance policy helps pay for covered losses, such as the other party’s medical bills and damage to their vehicle or other property that results from the accident

You need Compulsory Third Party (CTP) insurance before you can register your car in NSW. CTP insurance – also known as a green slip – provides compensation for other people injured in an accident when you or the person driving your vehicle is at fault, and in certain circumstances, regardless of who was at fault

Shopkeepers Insurance policy is a comprehensive package policy which provides financial protection to Insured’s shop assets & other risk exposures related to business activity in a single documentation

A shop has three important aspects that any good insurance policy should keep at its heart. Those three things are your premises and stock (buildings and contents insurance), your customers (public liability insurance) and protection of outgoing costs should you have to stop trading (business interruption insurance)

Primary and the major disadvantage of car insurance is your policy not covers the entire vehicle. Only the specific parts of the car are under damage coverage, the policyholder needs to verify hidden clauses in the document keenly before buying the policy