Cibil Score Check Online: Hello friends, welcome to all of you, in this article of ours today, through this article, we are going to tell you all about Free Full credit report, some important information related to what is cibil score check free, annual credit report, Or, what are the benefits of cibil score check online, Benifits Good Credit Score , what is the important information related to them, through this article we will tell you, then definitely read till the end.

Cibil Score Check Free: When it comes to getting a loan or a credit card, it’s likely that at some point you’ll need to approach a bank, Non-Banking Financial Company (NBFC), or an online lender. This can be for various reasons such as a business loan, credit card, education loan, wedding expenses, financial emergencies, or a home loan. When you apply for a loan, the lender will review your credit score and report to determine if you’re a suitable borrower. Your credit score, which is a three-digit number, plays a significant role in determining whether you qualify for credit and the interest rates you receive. In India, credit scores are provided by four credit bureaus: Equifax, Experian™, CIBIL™, and CRIF Highmark™. These scores range from 300 to 900.

Benifits Good Credit Score: Put yourself in the shoes of a bank or lending institution that continuously provides loans to customers from different backgrounds. As you continue to lend money to your customer base, you will eventually understand the importance of evaluating a customer’s credibility and ability to repay the loan before approving it. It has become essential to assess a customer’s creditworthiness in order to minimize the risk of potential bad debts in a financial institution.

Cibil Score Check Online: A credit score is a number given to a customer by credit bureaus based on their past credit information. (Benifits Good Credit) ScoreThese bureaus analyze the payment history of loans and credit cards to create credit reports. Banks and financial institutions use these reports to assess loan applications.

Contents

- 1 What Is Credit Score?

- 2 Why Is Cibil Score Important?

- 3 How and where can you check your credit score for free?

- 4 Here is the notification from the Reserve Bank of India (RBI).

- 5 How to Easily Access Your Free Full Credit Report from CIBIL

- 6 Why do credit scores differ Among Indian bureaus?

- 7 Good vs. Bad vs. No Credit Score:

- 8 How Can You Maintain a Good Cibil Score in India?

- 9 The Benifits of Having a Good Credit Score

- 10 1. Easy Loan Approval:

- 11 2. Lower Interest Rates:

- 12 3. Access to Higher Credit Limits:

- 13 4. Better Insurance Premiums credit report:

What Is Credit Score?

Cibil Score Check Free: A credit score is a numerical representation of an individual’s creditworthiness. It is a measure used by lenders to assess the risk of lending money to someone. The score is typically based on an analysis of a person’s credit history, including their payment history, amount of debt, length of credit history, types of credit used, and new credit applications. (Benifits Good Credit Score) A higher credit score indicates a lower risk for lenders, making it easier for individuals to obtain loans and credit cards at favorable interest rates.

In India, the credit score distribution is as follows:

| Credit Score Range | % People |

|---|---|

| < 600 | 22.87 |

| 600 – 649 | 10.51 |

| 650 – 699 | 9.75 |

| 700 – 749 | 18.89 |

| >= 750 | 37.98 |

Why Is Cibil Score Important?

Cibil Score Check Free: Before we delve into this section, let’s consider a simple question – “Would you lend money to someone you don’t know?” Most of you would likely shake your heads and say “No”. The only scenario where you might consider lending money to a stranger is if you know them personally or if someone you trust vouches for them.

To put it simply, banks faced a similar issue when it came to lending money. They lacked the necessary parameters to make informed lending decisions. Cibil Score Check Online This is why loans were primarily offered to existing account holders or why it took a significant amount of time to approve loans for new customers, as verifying the provided documents was a lengthy process.

A person’s credit score acts as that trusted friend vouching for them. Credit bureaus hold all the information about an individual’s credit history and provide a background report to lenders, such as banks or NBFCs (Non-Banking Financial Companies). Therefore, a high credit score indicates responsible credit management, increasing the likelihood of loan or credit card approval, as well as better offers in the future.

How and where can you check your credit score for free?

CIBIL SCORE :

CIBIL, also known as Credit Information Bureau India Limited, is the first Credit Information Company (CIC) in India. It was founded in August 2000. CIBIL collects credit information from various banks and financial institutions about the payment history of their customers’ loans and credits. This information is then used to generate credit information reports and credit scores for the customers. These reports are provided to the member banks and financial institutions, who use them to assess and approve loan applications.

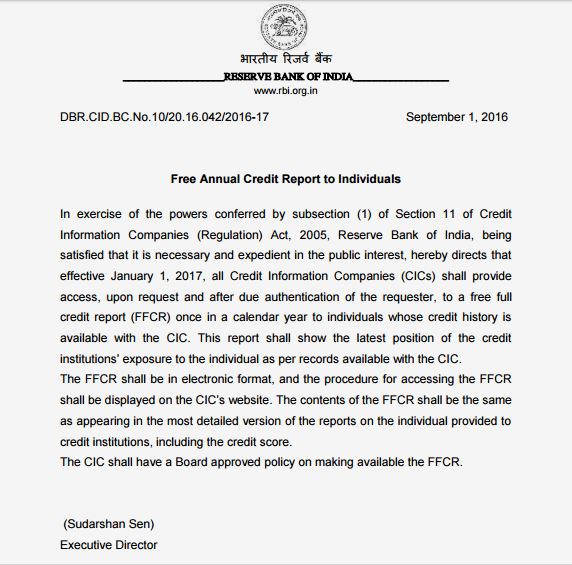

The Reserve Bank of India issued a notification in September 2016, instructing all credit information companies to offer individuals one complimentary full credit report if their credit history is on record with them. This provision will come into effect from January 1, 2017. Additionally, the notification mandates that credit information companies must inform individuals about the process for accessing these free full credit reports on their respective websites.

Here is the notification from the Reserve Bank of India (RBI).

How to Easily Access Your Free Full Credit Report from CIBIL

Step-1:

- Visit the link https://www.cibil.com/freecreditscore/.

- Under the heading “ONLINE FREE CIBIL SCORE & REPORT ORDER FORM,” locate the three main lines arrangement.

- Select the option “I want my Free CIBIL Score & Report.”

- Provide the requested details such as email address, date of birth (DOB), gender, and PAN. If you don’t have a PAN, you can submit details of any other ID proof.

- Enter the captcha code and click on ‘submit.’

- Provide your address and contact number, then click on the submit button.

- Skip the pop-up page that shows the difference between free CIBIL report and paid CIBIL credit report by clicking on ‘no thanks.’

Step-2:

- Optionally, provide an alternate email address. This step can be skipped if you consider it unnecessary.

- You will receive an SMS and an email containing the login credentials to access your free full credit report.

- Visit the following link to log in using the received credentials.

- Click on “Click Here for Official Website.”

- After successful login, you can find your credit score displayed on the welcome page at the top bar.

Why do credit scores differ Among Indian bureaus?

If you have obtained your credit score from different bureaus, Cibil Score Check Free you may have noticed that your score varies from bureau to bureau. This variation occurs due to the following reasons:

-

Each credit bureau has its own unique method for calculating credit scores. As a result, your score will differ across bureaus.

-

Your lender may not have reported your recent credit data to a particular bureau or may not be reporting to that bureau at all. Consequently, if you check your score with that specific bureau, it might appear lower.

Although your credit score may vary, lenders are aware of the different scoring models used by various bureaus and consider the scores equally.

Good vs. Bad vs. No Credit Score:

When it comes to credit scores, individuals typically fall into one of the following categories: good, bad, or no credit score. The table below will help you understand the importance of credit scores and their associated benefits.

| Good Score | Bad Score | No Score | |

|---|---|---|---|

| Range | 750 and above | Below 600 | No credit activities reported |

| Interest rate on loans | Low | High | Average, fixed based on income and employer |

| Loan approval rate | High | Low | Depends on the policies of the lender |

| Payment history | Good | Poor (Late payments and defaults) | No history |

| Credit utilization ratio | Excellent | Poor | No records found |

How Can You Maintain a Good Cibil Score in India?

Maintaining a good credit score in India is crucial. Here are some effective tips to help you achieve this:

1. Pay your bills on time: Timely payment of credit card bills, loan installments, and other debts is essential. Late payments can negatively impact your credit score.

2. Keep credit utilization low: Try to use only a small portion of your available credit limit. High credit utilization can indicate financial stress and affect your credit score.

3. Maintain a healthy credit mix: Having a mix of different types of credit, such as credit cards, loans, and mortgages, can positively impact your credit score. However, avoid taking on too much debt.

4. Regularly check your credit report: Obtain a copy of your credit report from credit bureaus like CIBIL, Experian, or Equifax. Review it for any errors or discrepancies and report them immediately.

5. Avoid multiple credit applications: Applying for multiple loans or credit cards within a short period can make you appear credit hungry, which can lower your credit score. Only apply for credit when necessary.

Remember, building and maintaining a good credit score takes time and discipline. By following these tips, you can improve your creditworthiness and enjoy the benefits of a good credit score in India.

The Benifits of Having a Good Credit Score

Benifits Good Credit Score: Having a good credit score can bring about numerous benefits. A credit score is a numerical representation of an individual’s creditworthiness, and it plays a significant role in various financial aspects of life. Here are some of the advantages of having a good credit score: (Benifits Good Credit Score)

1. Easy Loan Approval:

enders, such as banks and financial institutions, consider a good credit score as a sign of responsible financial behavior. When you have a good credit score, it becomes easier to get approved for loans, including personal loans, car loans, and mortgages. With a higher credit score, you are seen as a low-risk borrower, making lenders more willing to provide you with favorable loan terms and interest rates.

2. Lower Interest Rates:

A good credit score can lead to lower interest rates on loans and credit cards. Lenders are more likely to offer competitive interest rates to individuals with a good credit history. This means you can save a significant amount of money over time by paying less interest on your loans and credit card balances.

3. Access to Higher Credit Limits:

With a good credit score, you may have access to higher credit limits on your credit cards. This allows you to have more purchasing power and flexibility in managing your finances. However, it is important to use credit responsibly and avoid overspending, even with higher credit limits.

4. Better Insurance Premiums credit report:

Many insurance companies consider credit scores when determining insurance premiums. With a good credit score, you may qualify for lower premiums on auto insurance, homeowner’s insurance, and other types of insurance. This can result in substantial savings on your insurance costs.

In conclusion, having a good credit score can bring numerous advantages. It not only makes it easier to obtain loans and credit but also results in lower interest rates, higher credit limits, better insurance premiums, increased rental approval chances, and improved job prospects. Maintaining a good credit score is essential for a healthy financial future.

-

How To Get Paytm BC Point,Paytm BC, Paytm Bank Mitra Apply 2023

-

Victoria Pedretti Net Worth 2023: Biography Career Income

-

Elle Fanning Net Worth 2023: Wiki Age Biography Boyfriend Income

-

Reese Witherspoon Net Worth 2023: Biography Career Income

Cibil Score Check Online

Poonawalla Fincorp’s website offers a free feature for checking your credit score, which fetches your score from the CIBIL website and displays it to you. The advantage of fetching your CIBIL score from Poonawalla Fincorp is that you get instant access to a bouquet of loans from us as soon as you get your CIBIL score. These loans have the “PFL advantage” of attractive interest rates, best-in-class customer service, a digital-first platform, complete transparency and a smooth, hassle-free process.

Benifits Good Credit Score

A 715 credit score is a good credit score. The good-credit range includes scores of 700 to 749, while an excellent credit score is 750 to 850, and people with scores this high are in a good position to qualify for the best possible mortgages, auto loans and credit cards, among other things.

TransUnion CIBIL is among the oldest and most reputable Credit Information Companies in India. Nearly all leading organisations are members of the company. CIBIL collects, analyzes and maintains the information of different business entities. It offers a CIBIL rank and report for organisations.

annual credit report: Which of the three credit bureaus is the best? Of the three main credit bureaus (Equifax, Experian, and TransUnion),(annual credit report) none is considered better than the others. A lender may rely on a report from one bureau or all three bureaus to make its decisions about approving your loan, annual credit report