Hello Guys, welcome to all of you, through this article today, through this article, we are going to tell you all about PhonePe Loan Online Apply, some important information related to phonepe loan interest rate, phonepe loan Eligibility Criteria, what is it or what are the benefits of PhonePe Loan Feature, Documents Required PhonePe Loan, what is the important information related to them, through this article we will tell you, so definitely read till the end.

Phonepe, a payment application launched by Flipkart in 2015, has become the leading online payment app in India, surpassing even Google Pay. With its reliability and speed, Phonepe has revolutionized the way people trade money, making India a cashless society.

The application has made life easier for millions of people, eliminating the need to carry physical cash. Sending money to someone is as simple as using the app. In this article, we will provide a detailed guide on how to obtain a loan through Phonepe.

Contents

- 1 PhonePe Loan 2023

- 2 PhonePe Loan Features

- 3 PhonePe Loan Key Highlights 2023

- 4 PhonePe Loan 2023 Benefits

- 5 PhonePe Loan Interest Rate

- 6 PhonePe Loan 2023 Eligibility Criteria

- 7 Process To Apply Online/Offline PhonePe Loan 2023

- 8 Documents Required PhonePe Loan 2023

- 9 PhonePe Loan Key Highlights 2023:

- 10 Application process (Online/Offline)

- 11 Let’s see the steps by which you can easily avail of the phonepe loan Eligibility Criteria PhonePe Loan:

- 12 क्या फोनपे लोन ऑफर करता है?

- 13 कौन सा ऐप मुझे 20k लोन दे सकता है?

PhonePe Loan 2023

Introducing PhonePe, a newly launched microlending platform that offers loans with a minimal fee. What sets PhonePe apart is its lower interest rate compared to other lending institutions. If you’re in need of immediate funds, PhonePe Loan 2023 is your best solution. Once approved, you can conveniently transfer the loan amount to your bank account and use it for purchases anywhere. Although the current loan amount may not be substantial, it is anticipated to grow over time. PhonePe’s loan service is an impressive innovation, especially considering its early stage. For more details on the PhonePe Loan 2023 Interest Rate, please refer to the complete article.

PhonePe Loan Features

PhonePe Loan Feature 2023 : PhonePe App stands out from its competitors by offering loans in addition to its other services. The loan application process is quick and hassle-free, requiring only minimal documentation. Although the loan amount may not be substantial, it’s commendable that PhonePe has introduced this feature. PhonePe Loan Feature What sets them apart even further is their offer of 0% interest on loans for the initial 45 days, something rarely seen in the industry. PhonePe has evolved into much more than a mere payment app and continues to expand its offerings.

- Quick and convenient loan application process

- Instant approval and disbursal of funds

- Flexible loan amounts to choose from

- Competitive interest rates

- Repayment tenures tailored to suit individual needs

- Minimal documentation required

- Available for both salaried and self-employed individuals

- Online application and tracking facility

- No hidden charges or prepayment penalties

- Secure and reliable platform provided by PhonePe

PhonePe Loan Key Highlights 2023

| Article Title | PhonePe Loan 2023 Interest Rate |

|---|---|

| Application Name | PhonePe Loan |

| Headquarter | Bengaluru |

| Category | Finance & Loan |

| Launched on | 2015 |

| Type | Payments App |

PhonePe Loan 2023 Benefits

PhonePe serves as a convenient one-stop solution for all UPI-based transactions. Users can link their bank accounts from any bank to the PhonePe app, eliminating the need for multiple app installations. Whether you’re dining out, going on a trip, or watching a movie, PhonePe’s “Split a bill” feature makes it easy to share expenses among friends. Enjoy the following benefits of PhonePe Loan 2023.

- Quick and easy access to personal loans with instant approval.

- Low interest rates and flexible repayment options.

- 24/7 availability of PhonePe loan services.

- No collateral or documentation required.

- User-friendly UPI-based app accessible 24/7.

- Secure transactions and immediate discounts on purchases.

- Hassle-free and secure online loan process.

- Convenient solution for financial emergencies.

- No need to remember bank account details (IFSC code) for transactions.

- Rapid money transfer on the go.

PhonePe Loan Interest Rate

The loan is completely interest-free for the initial 45 days, making it a hassle-free borrowing option. Moreover, it is a convenient choice that requires minimal paperwork.

PhonePe Loan 2023 Eligibility Criteria

Before applying for a loan in PhonePe, it is important to understand the eligibility criteria. Having a good loan repayment history and meeting the age requirements are essential. PhonePe, being a relatively new player in the industry, is striving to achieve greater success. As a payment app, PhonePe is considered one of the top options available.

- Aadhar Card: Must be linked to your mobile number and attached as proof.

- Pan Card: Required as identification and financial document.

- Cibil Score (700+): Mandatory for loan eligibility and favorable loan terms.

Here are some of the requirements that need to be met:

- CIBIL score: Must be higher than 700 for loan approval.

- Bank Account: Required, with a minimum age of 18.

- Phone Number: Should be linked to your Aadhaar card and bank account to avail benefits.

- CIBIL score below 700: May result in lower chances of loan approval.

- Age requirement: Not explicitly specified, but a bank account typically requires the account holder to be at least 18 years old.

Process To Apply Online/Offline PhonePe Loan 2023

“The application process for PhonePe loans is conducted entirely online through the PhonePe application. Unlike traditional banks, PhonePe does not have any physical branches available. However, their digital presence has been rapidly expanding, and the addition of this loan feature will further contribute to their success. The application process is hassle-free and convenient, with minimal paperwork required. To apply, you simply need to install two applications and use the same mobile number for both.”

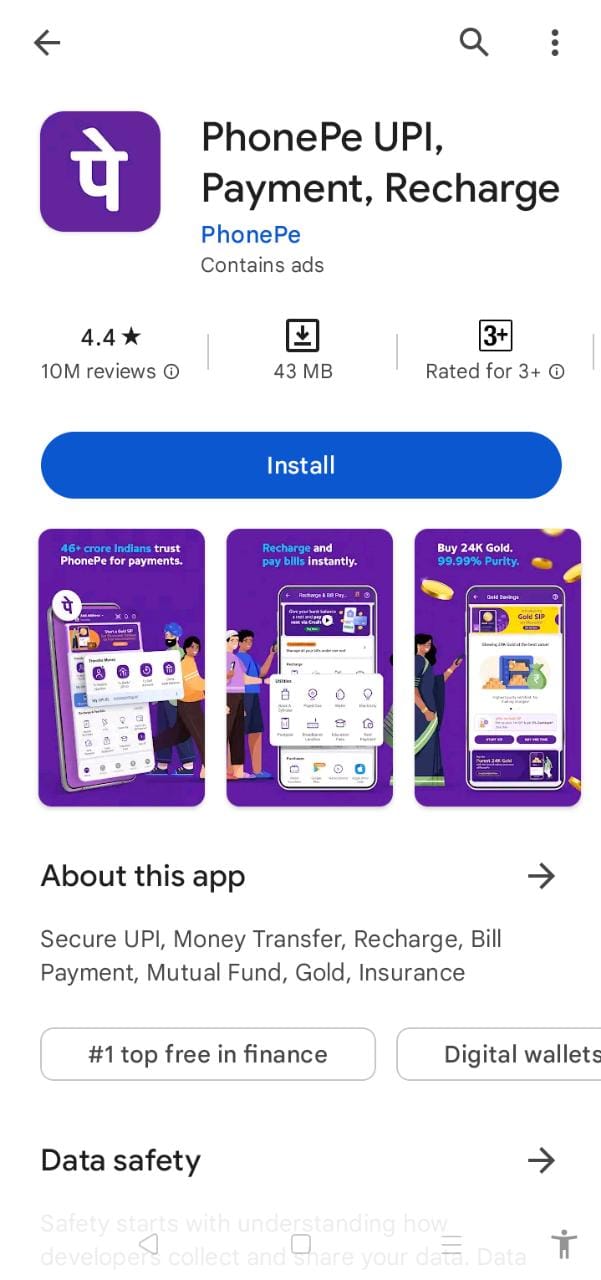

- Download the PhonePe application from the play store or any app store.

- Register with the phone number linked to your bank account and Aadhaar card.

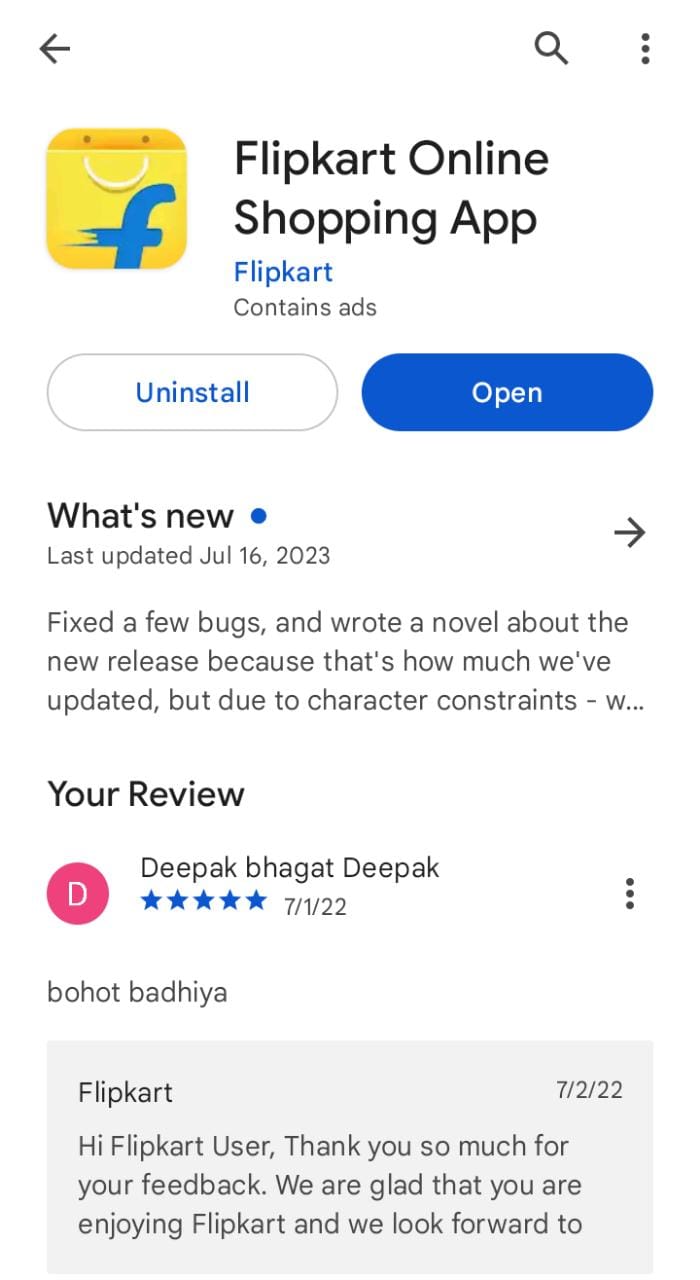

- Install the Flipkart app from the play store or any app store.

- Register on Flipkart using the same phone number as used in PhonePe registration.

- Complete the required self-details and KYC on the Flipkart application.

- Upon successful KYC, receive a credit amount ranging from 1000 to 10,000 in your Flipkart account, known as “Flipkart Pay.”

- The credit amount may increase based on good usage.

- Use the Flipkart Pay credit to make payments easily via PhonePe.

Documents Required PhonePe Loan 2023

Documents Required PhonePe Loan: Getting a loan from PhonePe is convenient and straightforward as they require minimal documentation. It’s a hassle-free process. Moreover, the loan comes with the perk of being interest-free for the initial 45 days.

- Aadhaar card with the same mobile number linked to your bank account.

- Pan card for successful KYC in the Flipkart application.

- CIBIL score of more than 700.

PhonePe App sets itself apart from others by providing loans. The loan application process is straightforward, requiring minimal documentation. While the loan amount may not be significant, it is a commendable initiative. Additionally, PhonePe is offering loans with 0% interest for the first 45 days, which is quite uncommon in this industry. No other company has offered loans at such favorable terms. PhonePe has evolved from being solely a payment app and continues to expand steadily.

PhonePe Loan Features: PhonePe App differentiates itself from its competitors by not only providing its regular services but also offering loans. The application process for these loans is fast and easy, with minimal documentation required. While the loan amount may not be significant, it is impressive that PhonePe has incorporated this feature. What further distinguishes PhonePe is their unique offering of 0% interest on loans for the first 45 days, which is rarely found in the industry. PhonePe has evolved into more than just a payment app and is continuously expanding its range of services.

PhonePe Loan Key Highlights 2023:

- Article Title: PhonePe Loan 2023 Interest Rate

- Application Name: PhonePe Loan

- Headquarter: Bengaluru

- Category: Finance & Loan

- Launched on: 2015

- Type: Payments App

Application process (Online/Offline)

The application process is completely online, as you do call the process on the phonepe application. There isn’t any offline branch available for phonepe. They are growing exponentially and with the inclusion of this loan providing feature, they will be even more successful. The application process is completely hassled free and convenient. You don’t need to do a lot of paperwork for it to be passed. You just need to install two applications and you need to provide the same mobile number in both applications.

Let’s see the steps by which you can easily avail of the phonepe loan Eligibility Criteria PhonePe Loan:

- Step I – First of all, you need to download the phonepe application from the play store or any other app store.

- Step II – Then you need to register in it with the same no. which is linked with your bank account and your Aadhaar card.

- Step III – Now you need to install the Flipkart app from the play store or any other app store.

- Step IV- Now you have to register on Flipkart with the same number with whom you had earlier registered in phonepe.

- Step V – Then you need to submit all the details about yourself and you need to do a little KYC on the Flipkart application.

- Step VI – Once your KYC is successful, a credit of any amount ranging from 1000 to 10,000 will be credited to your Flipkart account. It should be named as Flipkart Pay” later. The amount will increase if you remain good with it.

क्या फोनपे लोन ऑफर करता है?

कौन सा ऐप मुझे 20k लोन दे सकता है?

-

Core Banking Solutions: Definition, Features, and Benefits 2023?

-

Jana Bank FD Rates: 8.15%, Jana Bank Fixed Deposit Interest Rates 2023

-

How to Link Aadhaar Card to Bank Account Online/Offline?

PhonePe doesn’t provide loan directly, but phonepe help you to get the loan from their parent company Flipkart. To get the loan you need to connect with both apps. The Phonepe loan is totally interest-free for the first 45 days.

For salaried professionals, the minimum salary requirement set by most lenders is Rs. 15,000 or above. Note that individuals with a minimum salary of Rs 25,000 are preferred by lenders. In case of self-employed individuals, lenders usually require gross annual income of Rs. 2 lakh or more.

PhonePe loan can be accessed directly through the PhonePe app. This convenient feature allows users to easily pay off credit card bills, mobile bills, recharge their phones, shop on Flipkart, make electricity bill payments, Documents Required PhonePe Loan and even pay off loan EMIs. However, it’s important to note that the loan amount cannot be transferred to a bank account.

You can easily apply for a mobile loan by downloading the Navi app. Just enter your name, address and PAN card to check eligibility. Next, enter the loan amount and tenure. Complete the KYC process and enter your bank account details.